Ownership of the inventory is only transferred to the consignee upon sale to the end customer. At this time, the consignee recognizes revenue, and the consignor records the sale on the consignor’s financial statements. An example of consigned inventory is when a manufacturer or supplier provides goods to a retailer but retains ownership of those goods until they are sold to the end customer. Next, let’s examine the general accounting process for consigned inventory.

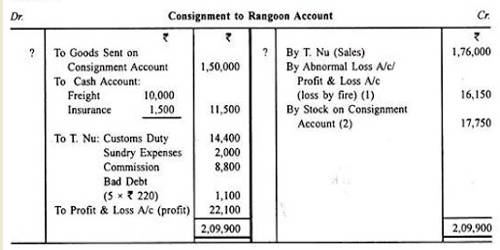

Consignor records the consignment sales and expenses journal entry

These GAAP differences can also affect the composition of costs of sales and performance measures such as gross margin. Consignment inventory can be a cost-effective way for retailers to stock their stores. And it allows suppliers to gain exposure without spending extra money marketing, selling, or displaying their products. It can be a win-win situation if both parties understand and agree upon the contract’s terms.

Consignment accounting

- In order to solve this problem, Mr. A allows the seller to put the books on their shelve without paying until they are sold.

- In essence, the consignor retains control and risk over the inventory until it is purchased by the end-user.

- Consigned goods enable businesses to maintain an adaptable inventory that can quickly respond to changes in demand and market conditions.

- Maybe you’re established, but the retailer doesn’t know you and is hesitant to hand over a fat check to purchase some of your products wholesale.

- This can be somewhat complex, but it’s important to understand the financial implications of such arrangements.

This delay can be advantageous for cash flow management, allowing the consignor to defer tax liabilities until the revenue is actually realized. However, it also necessitates meticulous record-keeping to ensure that all sales are accurately reported and taxed in the appropriate period. Consignment inventory is typically riskier for consigners than for consignees. If you have products you need to sell, we recommend consignment as one avenue for customers to find and purchase from you. There are better ways to sell your stuff full-time since you’re placing a lot of control into someone else’s hands. This post will discuss consigned inventory, explore consignment inventory arrangements, and explain how Xledger’s financial automation software can enhance consigned inventory management.

Accounting Method for Consignment Inventory

Consignment inventory can be a great way to offer products without taking the financial risk of purchasing them first. As you can see, using double-entry accounting is the easiest way to record these transactions. When you’re looking to do this in the easiest way possible, make sure that you use reliable accounting software.

Consignment Inventory Accounting Defined [+ Journal Entries]

The journal entries above are recorded in order to show the receipt of goods back to the consignee since they were unable to be sold by the consignee. In the instance where the consignee fails to sell the goods sent by the consigner, the consignee has the option to return the goods. The treatment of income taxes 2020 the return of the goods is similar to the treatment that is required when the goods are first sent to the consignee. Hence, inventory always continues to be recorded in the financial statements of the consigner, whereas the consignee is not supposed to record any inventory-related transactions.

The Pros and Cons of Consignment Inventory

Consignment inventory differs from this as the retailer retains responsibility for ensuring stock is at appropriate levels for their business. Remember, a robust financial management system like Xledger can elevate your inventory management strategies and drive success in modern business operations. As such, they are not left holding obsolete stock if market conditions change or demand shifts. This alleviates concerns for consignees and enables them to focus on selling current inventory without the fear of incurring losses due to obsolescence.

This is because the cost of bringing the inventory to its current location must be considered when calculating the cost of goods sold (COGS). The journal entry for consignment inventory is different from normal sale and purchase. The consignor allows the consignee to collect the revenue on their behalf. The consignor still owns the inventory and takes full responsibility for any risk of unsold or obsolete.

Also, predicting whether a product will be profitable and popular is almost impossible. Of course, you may have conducted the required research and kept up with all current market trends. New product offerings, no matter the sales channel, can be risky business in today’s retail environment.